Understanding Wraparound Mortgages in Owner Financing: A Complete Guide for Tennessee Buyers

- willbaugher

- Aug 12, 2025

- 4 min read

If you’ve been exploring owner-financed homes in Tennessee, you may have come across the term wraparound mortgage (often called a “wrap” loan). Wraparound mortgages are a popular tool in creative real estate financing, but many buyers don’t fully understand how they work—especially when the seller also purchased the home subject to an existing mortgage.

This article breaks down everything you need to know:

✅ What a wraparound mortgage is

✅ How it works for buyers and sellers

✅ Why it’s popular in owner financing

✅ Pros and cons for both sides

✅ Special risks if the seller bought “subject to”

📜 What Is a Wraparound Mortgage?

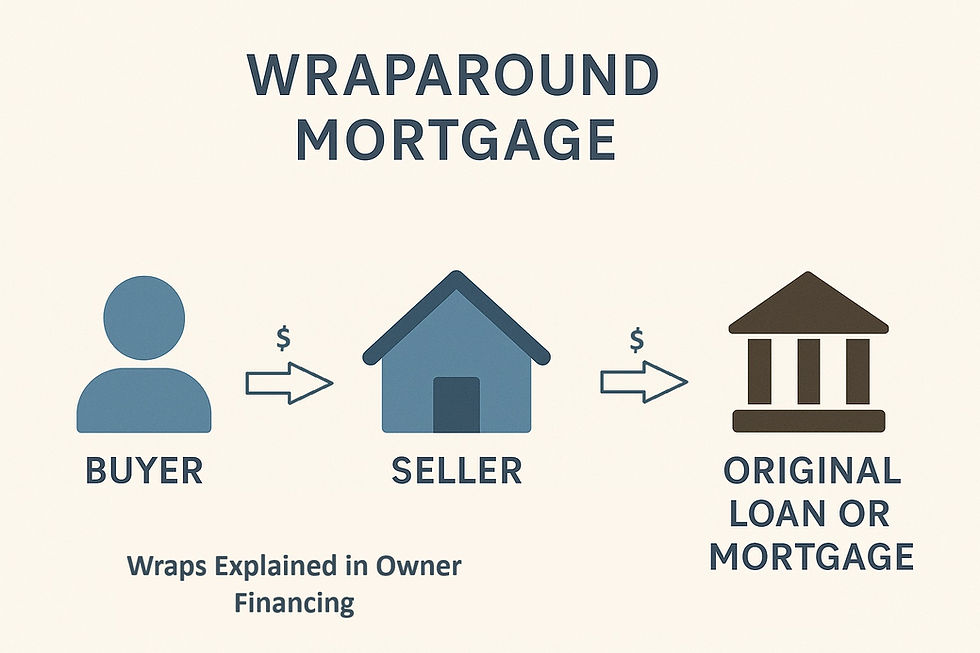

A wraparound mortgage is a type of seller financing where the seller’s existing mortgage remains in place, but the seller creates a new, larger loan for the buyer that “wraps” around the original one.

Here’s how it works:

The seller still owes money on their original mortgage.

The buyer purchases the home and makes monthly payments to the seller based on a new promissory note (often at a higher interest rate).

The seller uses part of the buyer’s payment to keep paying their original mortgage.

The difference between the old loan’s interest rate and the new one is the seller’s profit margin.

🔄 What Does “Subject to an Existing Mortgage” Mean?

Buying a property subject to an existing mortgage means the buyer takes ownership of the property but does not pay off the current loan. The original mortgage stays in the seller’s name, but the new buyer agrees to make the payments.

In a wraparound scenario, this can mean:

The seller bought the home subject to an existing mortgage and is now wrapping your loan around their seller's original loan.

There may be multiple layers of loans—so it’s crucial to know who is responsible for paying what.

📈 Why Are Wraparound Mortgages Popular in Owner Financing?

Flexibility for buyers – No need for traditional bank approval.

Higher profit for sellers – They can charge a higher interest rate than they pay on their existing mortgage.

Faster closings – Often completed in days instead of weeks.

Access to homes otherwise unavailable – Especially if the property has a low-interest loan that benefits the seller.

✅ Pros and Cons of Wraparound Mortgages

Feature | Wraparound Mortgage |

Ownership Transfer | Yes, buyer takes title |

Monthly Payments | Buyer pays seller; seller pays lender |

Existing Mortgage | Remains in place |

Interest Rate | Often higher than original loan |

Buyer Benefits | Easier approval, flexible terms |

Seller Benefits | Earn interest spread, sell to more buyers |

Buyer Risks | Loan could be called due (due-on-sale clause) |

Seller Risks | Buyer could default, leaving seller to pay the monthly payment withiout income to offset the cost |

⚠️ Special Considerations if the Seller Bought “Subject to”

If your seller also purchased the property subject to an existing mortgage:

Due-on-Sale Clause Risk – The original lender can demand full payoff if they discover the transfer. This is not likely or common, but it absolutely can happen. Buyers and Sellers alike need to have an exit strategy to plan for this in case it happens.

Multiple Layers of Debt – The more layers between you and the bank, the higher the risk something could go wrong.

Payment Chain Risk – You pay the seller, the seller pays their seller, and their seller pays the bank. If anyone in the chain misses a payment, foreclosure is possible—even if you’ve paid on time.

🏠 Tips for Tennessee Buyers Considering a Wraparound Mortgage

Get everything in writing - Ensure your wraparound mortgage is documented with a promissory note and recorded in the county where the property is located.

Ask for payment proof - Request quarterly (or even monthly) evidence that the seller’s original loan is being paid.

Understand the payoff terms - Some wraps include balloon payments in 3–5 years.

Hire a real estate attorney - Wraps can be complex; an attorney can ensure your agreement is enforceable.

Work with reputable sellers - Avoid anyone unwilling to be transparent about the existing mortgage.

Have the title reviewed - Make sure to close with a reputable title company and review the title search and purchase title insurance. There will be an exception for any mortgage taken subject to.

📌 Final Thoughts

A wraparound mortgage can be a fantastic way to buy a home in Tennessee without traditional bank financing, but it’s not without risk. If structured properly—with clear terms, payment verification, and legal protections—it can be a win-win for buyers and sellers.

At SEPFinancing.com, we specialize in helping Tennessee buyers understand their financing options, including wraparound mortgages, lease-options, and traditional seller-finance deals.

👉 Browse Tennessee owner-financed homes now and see if a wraparound mortgage is the right path for you.

If you want to learn even more about wraparound owner financing, we have another blog post that may interest you HERE.

If you are curious about the difference between "rent to own" and owner financing, check out THIS post.

Comments